Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

The design of Bitcoin Mark 3 (M3) aims to validate hypotheses related to scalability, usability, value creation, and portability, while benchmarking its outcomes against Bitcoin’s current performance.

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

RESEARCH ABSTRACT:

Bitcoin has transformed into an institutional success. However, its foundational vision of decentralized, peer-to-peer payments remains constrained by the technological limits of its time. The Bitcoin Mark 3 (BitcoinM3) theoretical model explores how Bitcoin’s original vision of decentralized payments can evolve with advancements in blockchain technology, governance, and economic design.

A true vision transcends time, technology, and approach. BitcoinM3 tackles Bitcoin’s key limitations by leveraging modern innovations to enhance scalability, economic stability, and real-world utility.

This “Mark 3” iteration represents the next phase in Bitcoin’s evolution—a concept that could help bridge the wealth gap and constructively reduce the deficit and national debt.

A second chance.

A smarter design.

A new beginning.

NOTE: This is a living document. All research elements are subject to change based on experimental results and community feedback.

Launched in 2008, Bitcoin revolutionized finance by introducing a decentralized, peer-to-peer digital currency system and pioneering the concept of digital scarcity with a fixed supply of 21 million coins. Although originally intended as a payment system, Bitcoin's limited transaction capacity of ~7 transactions per second and high fees during peak demand hindered its use for everyday purchases. However, Bitcoin’s strong security through proof-of-work and its growing reputation as “digital gold” led to its evolution from a payment method to a highly sought-after store of value. It became recognized as a hedge against inflation and a reserve asset for institutions and governments, solidifying Bitcoin’s transformation into a premier institutional product.

In 2015, the Lightning Network was introduced as Bitcoin’s second-layer solution, designed to improve scalability and reduce transaction costs. By enabling off-chain, instant payments through peer-to-peer payment channels, the Lightning Network opened up new use cases for micropayments, gaming, streaming, and tipping services. Despite these innovations, Lightning Network adoption faced challenges such as liquidity issues, complex channel management, and dependency on the slower Bitcoin base layer for final settlement.

With Bitcoin now established as an institutional product, the M3 experiment aims to overcome its technical and structural limitations to realize the original vision—a scalable, accessible, and value-generating digital financial system. A system built by the users, for the users, owned by the users—not controlled by institutions.

BitcoinM3 is an evolution of Bitcoin and Bitcoin Lightning, merging their security and trust with enhanced functionality. While maintaining digital scarcity with a fixed 21 million supply, M3 introduces scalable, low-cost transactions, blockchain adaptability, and intrinsic value creation through a decentralized treasury. Key Features:

Scarcity: Fixed supply @ 21M tokens.

Scalability: Faster, lower-cost transactions.

Intrinsic Value Creation: Treasury mechanisms for stability and compounding growth.

Portability: Adaptability to new blockchain platforms.

Resiliency with Innovation: Combining market trust with value-generating features.

Accessibility: For those that missed Bitcoin or sold too early.

Low Energy Use: More eco-friendly than PoW-based systems.

Smart Contracts: Advanced programmability for DeFi and dApp ecosystems.

Exploring the regulatory requirements, under the new administration, to test and refine a framework to properly tether a token to a treasury at the discretion of the user and the ability to transfer or cancel the tether based on conditions and rules. Creating maximum versatility and utility within the token.

Construct a stable value creation capability to support the durability and growth of the design.

Simulate converting 30% of the reserve into real-world financial instruments at maturity, including the S&P 500, Nasdaq 100, and Dow Jones, or their tokenized equivalents.

Simulate reinvestment of 40% fees: Test how reinvesting transaction fees into the treasury amplifies growth through compounding effects. Creating a two-fold growth engine for the M3.

Historical benchmark: The S&P 500 has delivered ~10x growth over the past 30 years, with annualized returns of ~10.7%. This would create a native, compounding, value generating capability for the M3. It would theoretically exceed the performance of the underlying security and Bitcoin.

BitcoinM3 Accelerates Beyond Bitcoin Long-Term

The reinvestment of transaction fees into index funds creates continuous compounding.

This results in a far more sustainable and high-growth model compared to Bitcoin.

The study will discover the key variables driving the models.

BitcoinM3 Designed for Value Creation

Bitcoin relies only on market speculation, while M3 actively reinvests and compounds value.

Once M3 surpasses Bitcoin, it never falls behind again because of the compounding advantage.

S&P 500 Anchors Stability

The 30% reserve allocation into the S&P 500, Nasdaq 100, and Dow Jones further stabilizes M3 - creates a base valuation.

This makes it less volatile than Bitcoin while still delivering superior returns.

When a viable model is developed, we will work with the SEC to institutionalize for adoption and consumption. One of the core objectives is to help contribute to a framework for future governance.

This initiative is strictly for research purposes. Should a commercial model emerge, the Treasury wallet will be entrusted to a Decentralized Autonomous Organization (DAO) designed to implement the objectives and findings of this study. As part of this exploration, we will assess blockchain ecosystems such as Solana, Ethereum, and others to identify the most suitable foundation for long-term viability.

The DAO, upon being granted control of the treasury, will assume the role of custodian operating in accordance with the principles and goals defined in this research. This research will determine the construct in which a DAO will be selected leveraging community voting at the discretion of the overseeing body.

A critical component in this Treasury model is the development of a proper voting capability for the token holders.

Once the Treasury is transferred to the DAO, this conceptual voting model will become the basis of governance and administration of the M3, within the DAO. Creating an optimal decentralized service that benefits the people and its constituent holders versus institutions.

M3 will initially leverage Solana on the Raydium Exchange to conduct its experiment. The exploration of M3 follows a structured, hypothesis-driven experiment aimed at testing critical assumptions about scalability, value creation, and portability in decentralized systems. The design does not represent a finalized product but serves as a framework for research. The experiment will be broken into four objective phases. Each new phase starts when the discretionary conditions (to be determined) are met.

Stablecoins, particularly those pegged to the U.S. dollar, have gained popularity as a digital representation of fiat. However, their design is limited: they function solely as a stable medium of exchange without contributing to economic reinvestment or value creation. Their primary value is preserving dollar equivalence, not expanding opportunity.

M3 is designed to achieve greater utility and alignment with national economic interests, while introducing dynamic features that go beyond what stablecoins can offer.

Governments—especially the United States—encourage stablecoins to be pegged to USD to avoid diminishing demand for the dollar. M3 accomplishes this same alignment, but with a smarter mechanism:

M3’s treasury is denominated in USD, invested in major U.S. index funds such as the S&P 500 and Nasdaq 100.

This not only preserves demand for the U.S. dollar, but actively supports U.S. capital markets.

The model ensures that M3 remains economically tied to the strength of the U.S. economy, rather than competing with it.

Unlike stablecoins, which are static in value, M3 is designed to grow:

Transaction fees generated by usage are systematically reinvested into the underlying USD-based securities.

This creates a compounding growth engine—building value over time and providing reinforcement for the underlying economic system.

The more the system is used, the more capital is recycled into the U.S. financial ecosystem, creating a positive feedback loop of usage, growth, and reinvestment.

M3 bridges the benefits of multiple monetary instruments:

Like a stablecoin: It preserves USD alignment and transactional convenience.

Like a treasury: It accrues value through real asset growth.

Like a utility token: It enables ultra-fast, ultra-low-cost peer-to-peer transactions globally.

USD Alignment

Yes

Yes (via treasury investment)

Value Growth

No (static)

Yes (compounding returns)

Supports U.S. Markets

No (static holdings)

Yes (index fund reinvestment)

Store of Value

Weak

Strong and growing

Medium of Exchange

Moderate

High-speed, low-cost

End-to-end efficiency in payments

Economic growth through reinvestment

Long-term store-of-value capabilities

Alignment with national currency priorities

In short, M3 is built not to replace the dollar—but to enhance it, support it, and create the next evolution of digital money rooted in real economic productivity.

Bitcoin, as envisioned by Satoshi Nakamoto, introduced a peer-to-peer electronic cash system that removed intermediaries, empowered individuals, and enabled frictionless value transfer. While revolutionary, Bitcoin was not initially designed as a store of value. Its reliance on scarcity and collective belief for valuation lacks intrinsic value creation, a feature critical for long-term stability. As a Mark 1 design, Bitcoin’s technology was also constrained by early limitations in scalability, transaction speed, and adaptability.

Since it's start, Bitcoin has benefited from:

Rapid Price Appreciation: Significant growth driven by increasing adoption and its constrained supply.

Faith-Based Resiliency: Market trust comparable to assets like art or religion has given Bitcoin durability through belief in its value.

Regulatory Framework: Bitcoin previously benefited from regulations that restricted institutional-grade competition, but this may change under the new administration, opening the door for emerging alternatives with superior scalability, efficiency, and economic utility.

Despite Bitcoins major wins as a peer-to-peer electronic cash system, Bitcoin also faces challanges.

Resilient Architecture: Bitcoin's framework prioritizes stability and decentralization, making it resistant to rapid change. While not entirely immutable, updates are slow and require widespread consensus, raising long-term competitive and security concerns as technology and threats evolve.

Scalability, Efficiency & Cost: Bitcoin’s high energy consumption, low transaction speed, and high fees make it inefficient for payments. Its design limits scalability, making everyday transactions slow and costly.

Demand Curve Maturation: Without mechanisms to generate intrinsic value, Bitcoin risks stagnation as adoption slows.

At $100K, Bitcoin’s path to $1M offers only a 10X return, making it a high-risk asset increasingly dominated by institutions, limiting accessibility for everyday consumers.

Bitcoin historically benefited from a regulatory environment that restricted competition, but now faces intense pressure from superior alternatives.

Lack of Utility: Unlike gold or property, Bitcoin does not generate functional economic demand. Bitcoin’s value relies solely on scarcity and speculation, with no built-in mechanisms for real economic growth or functional utility.

To serve as a durable and stable store of value, an asset must:

Provide Utility: Gold and property offer tangible uses that sustain demand. Meanwhile, art and collectibles offer unique utility through their scarcity, nostalgic appeal and the emotional value they hold.

Enable Growth: Intrinsic value mechanisms, such as tethered treasuries, create stability over time.

Bitcoin’s reliance on scarcity and speculative interest may leave it vulnerable to stagnation. Exploring mechanisms like treasury tethering or reinvesting transaction fees could address these risks and ensure its long-term viability.

Like Bitcoin, the current design call for the M3 to have a permanently fixed supply of 21 million tokens, ensuring scarcity as a fundamental principle. This design preserves long-term value integrity while integrating additional features that enhance liquidity and transaction efficiency.

Current research suggests that for stability, the theoretical starting design should follow a structured approach. To ensure orderly token distribution, liquidity will likely be introduced in a centralized, phased manner. This experimental process is designed to study token circulation mechanics, facilitate smooth distribution, mitigate supply shocks over time, and evolve an optimal design.

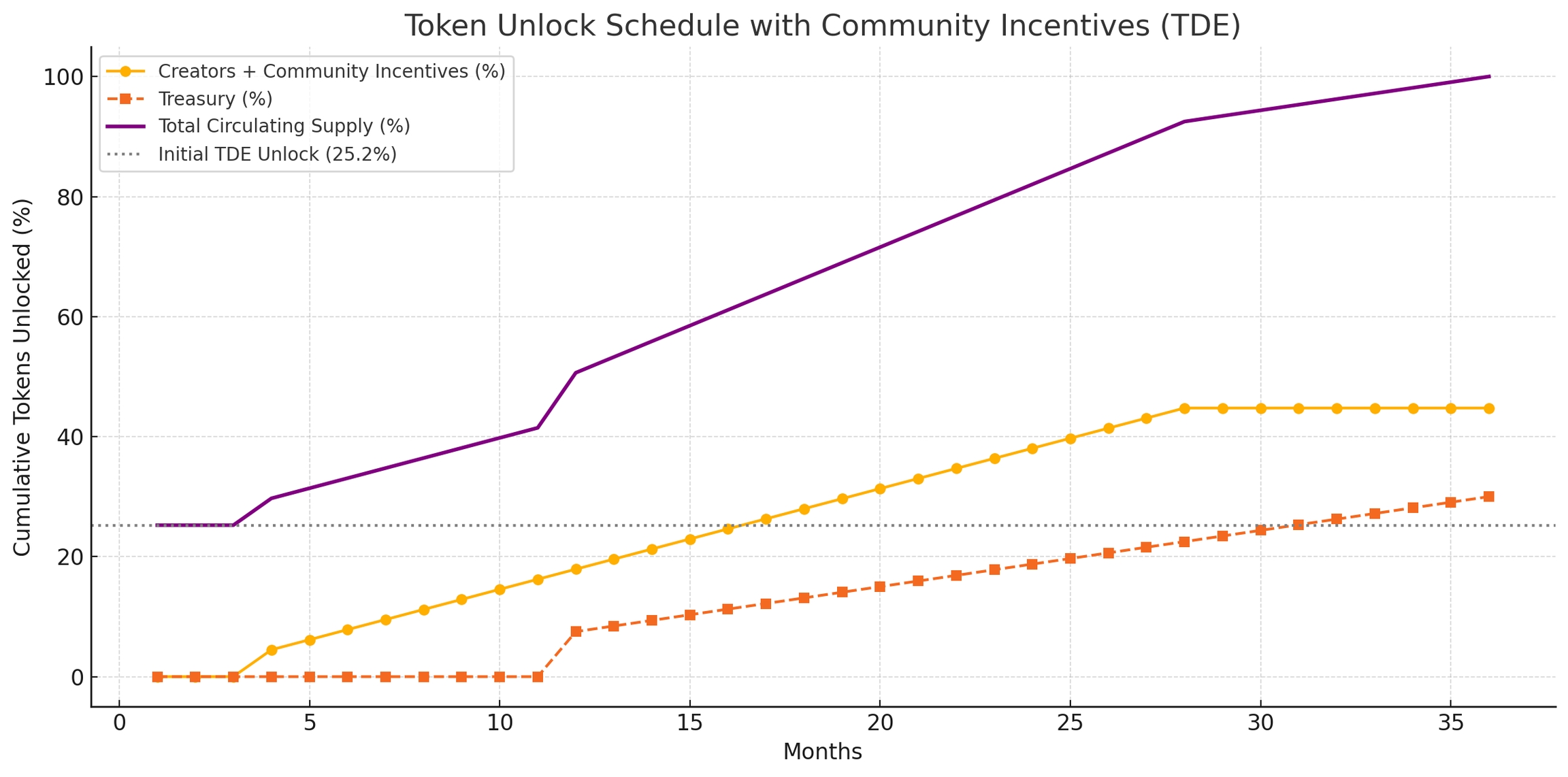

Here is the prelimary economics for the test token. This design will be reviewed and analyzed for viability.

Creators & Community Incentive Pool (Locked & Vesting)

Total Allocation: 9,400,000 tokens

Initial Unlock at TDE: 0 tokens

Lock-Up Duration: 3 months

Unlock at Cliff: 10% of the allocation

Remaining Unlock Schedule: Over 24 months, unlocked monthly and evenly distributed via daily automated scripts, ensuring consistent and transparent daily releases.

Supports Staking? Yes, if the design warrants, staking rewards can be distributed within the same vesting schedule while being locked.

Treasury (Locked & Vesting)

Total Allocation: 6,300,000 tokens

Initial Unlock at TDE: 0 tokens

Lock-Up Duration: 12 months

Unlock at Cliff: 25% of the allocation

Remaining Unlock Schedule: Over 24 months, unlocked monthly and evenly distributed via daily automated scripts, ensuring consistent and transparent daily releases.

Public Distribution & Liquidity (Unlocked at TDE)

Liquidity Pool: 2,100,000 tokens (fully unlocked at TDE)

Public Distribution: 3,200,000 tokens

Immediate Release: 3,200,000 tokens at TDE

Discretionary Release: 2,100,000 will be distributed to help maintain accessibility and mitigating sudden market spikes. Any release will not exceed 100,000/day.

Total Initial Circulating Supply at TDE: 5,300,000 tokens (~25.2% of total supply)

At TDE: 5,300,000 tokens will enter circulation (Liquidity + Public Distribution)

After 3 months: Creators & Community Incentives start unlocking (10% cliff unlock, then daily)

After 12 months: Treasury unlocks 25% at cliff, then continues daily unlocks over 24 months.

Full unlock period: Complete token release happens over a 3-year period.

As part of this experiment, we will explore the roles of market makers and other entities in supporting liquidity and their impact on overall market operations. This research will help us better understand how different participants contribute to market efficiency, price stability, and long-term sustainability.

Engineering key innovations to bridge the wealth gap, reduce deficits, and create sustainable solutions for the national debt. Variables and assumptions for consideration.

The Power of New Asset Classes Throughout history, new asset classes—from equities and real estate to digital assets—have ignited major economic booms. The M3 experiment explores the design of a highly liquid growth asset that serves as both a store of value and a superior transactional medium. By studying its ability to combine asset appreciation with real-world utility, we aim to evaluate its potential role in shaping modern economic systems.

Economic Potential of M3 If the M3 experiment follows the success of its predecessor, it could unlock substantial economic activity, driving increased investment, transactions, and overall market participation—potentially reshaping financial ecosystems.

Reflating the Consumer Asset Base The M3 experiment aims to strengthen the financial foundation of the average consumer, fostering wealth creation and financial stability. By improving debt ratios, income levels, and overall standards of living, M3 could contribute to a healthier, more resilient economy.

GDP Growth & Multiplier Effect Modeling GDP impact through the multiplier effect, where increased economic activity and investment drive higher consumer and institutional participation. Understanding these behavioral shifts helps assess the broader economic impact of M3 on growth, productivity, and long-term stability.

Charity and Support Programs for the Underserved A foundational principle of BitcoinM3 is leveraging decentralized value creation to drive sustainable impact. By utilizing M3’s self-sustaining treasury mechanisms, can we fund vital programs for food security, first responders, combat veterans, educators, and other underserved communities? Unlike traditional charity models, M3’s design fosters long-term support through value growth, ensuring that contributions are not only impactful but also continuously replenished—a model for responsible capitalism.

Deficit Reduction & Economic Growth Higher transaction activity can drive greater proceeds and tax receipts, while a wealthier population reduces reliance on government spending programs. Increased economic activity could further shift the deficit toward a surplus, creating a more self-sustaining economy.

National Debt Reduction The potential for balanced budgets and dedicated tax treatment from M3 proceeds could create a sustainable pathway to reducing national debt, ensuring long-term economic stability.

Exploring a framework for Universal Basic Income. As automation and AI accelerate, widespread employment disruption is inevitable. Establishing a sustainable economic framework for Universal Basic Income (UBI) could help mitigate financial instability and ensure economic resilience in a rapidly changing job market.

Economic & Social Impact Alleviating financial stress on the average household could significantly improve mental health and overall well-being, leading to both tangible and intangible economic benefits—including increased productivity, consumer confidence, and social stability.

With the transaction utility and treasury both serving as value-generating components, it is theoretically possible to migrate Bitcoin Mark 3 (M3) to any new blockchain infrastructure as superior technologies emerge. This flexibility ensures that M3 remains future-proof while maintaining user engagement and financial stability.

Unlike traditional blockchain models where the underlying technology defines the long-term capabilities of the network, M3 separates its value creation mechanisms into two distinct but interconnected layers:

Transaction Utility Layer:

The blockchain provides speed, scale, security, and smart contract execution.

Any blockchain that delivers superior transaction efficiency, low costs, and governance flexibility can theoretically serve as a new foundation.

Just as fiat currencies transition between paper types, digital payment platforms, or security features, M3 can migrate while preserving its core functionalities.

Treasury and Value Growth Layer:

The treasury serves as the financial engine that supports long-term value stability, independent of the underlying blockchain technology.

Growth is fueled by transaction fees, reinvested assets, and potential future financial models once regulatory frameworks are established.

Any migration would simply require creating a new coin standard, tethered to the treasury, ensuring a seamless transition.

Technology-Driven Migration Strategy:

The blockchain selected must match or exceed existing capabilities in:

Transaction Speed & Cost: Must remain <1 second finality and <$0.01 per transaction.

Scalability: Capable of handling mass adoption without congestion.

Security & Compliance: Must meet evolving regulatory standards and governance best practices.

Just as financial institutions upgrade payment infrastructure, M3’s modular architecture ensures a structured transition with minimal disruption.

Treasury-Centric Value Transfer:

The treasury ensures continuity by retaining all prior transactional value, fees, and investment mechanisms.

Users transition to the new blockchain by minting a new M3 standard token, backed by the existing treasury, preserving stability.

Where models like transfer of old tokens will result in a transfer of new tokens.

SEC-Compliant Transition Plan:

The migration process will be fully aligned with SEC guidelines, ensuring that any tethering mechanism meets legal requirements.

The Treasury remains separate from the blockchain layer, ensuring that any new M3 version is structured as a utility with no inherent financial guarantees.

The final framework will be submitted for regulatory review, ensuring a compliant transition model.

Long-Term Stability with Technology-Agnostic Value:

Unlike traditional cryptocurrencies that rely solely on network effects, M3 is designed for adaptability, ensuring its treasury-backed value remains intact even if the underlying blockchain evolves.

A successful SEC-approved model would create a true technology-agnostic vehicle, allowing continuous innovation without compromising trust, scalability, or regulatory security.

M3’s transaction utility drives economic activity, making it blockchain-independent.

The treasury ensures long-term stability, allowing seamless migration to superior blockchain solutions.

A compliant transition model, working within SEC frameworks, ensures legitimacy and long-term viability.

Modular architecture enables M3 to evolve with emerging technologies, protecting its users from obsolescence.

This model ensures that M3 can continue to function, scale, and create value, regardless of the underlying blockchain infrastructure, making it a fully adaptable and future-proof financial system.

Modeling and Frameworks: Contributing to Review and Design of the Economic Model Engage in open research, feedback, and eventually governance. Crowdsourced simulations and comparative analyses with traditional and blockchain-based systems. Develop a DAO-driven governance system. Validate the model’s viability in real-world scenarios. Educational initiatives such as webinars, workshops, and a collaborative knowledge repository. Foster a participatory ecosystem where the economic model evolves through collective intelligence and transparent decision-making.

Transfers: Evaluating the system’s ability to facilitate fast, low-cost international transfers and user feedback and adoption modelling.

Microtransactions: Simulating small-value payments for digital goods and services.

Smart Contracts: Testing programmable features such as conditional payments, escrow, and compliance automation.

Governance Models: Participants will simulate decision-making processes, such as voting on features and evaluating experimental outcomes.

Hypothesis: Modern blockchain technologies can surpass Bitcoin in transaction speed and cost-efficiency.

Bitcoin Performance:

Transaction Speed: ~7 transactions per second (TPS).

Average Cost per Transaction: ~$1.50–$2.50 (varies with network demand).

Settlement Time: ~10 minutes (on-chain).

M3 Target Performance:

Transaction Speed: ~65,000 TPS (Solana benchmark).

Average Cost per Transaction: <$0.01.

Settlement Time: <1 second.

The experiment aims to demonstrate a significant improvement in transactional efficiency, making decentralized payments feasible at a global scale.

We will also explore other cutting-edge blockchain technologies, such as Ethereum 2.0, Ripple/XRP, Avalanche, Polkadot, and Algorand, to ensure a comprehensive evaluation of viable platforms. Solana has initially been selected as the experimental blockchain layer due to:

High Performance: Solana supports up to 65,000 transactions per second (TPS), ensuring scalability for high-volume scenarios.

Cost Efficiency: Transaction fees average less than $0.01, making it economically feasible for microtransactions and global usage.

Energy Efficiency: Proof of History (PoH) ensures low environmental impact compared to Bitcoin’s Proof of Work (PoW).

Resilience Under Load: Solana’s architecture allows consistent performance under high transactional demands.

Transaction Speed @ Scale and Purpose: Targeting settlement times of <1 second.

Cost Efficiency: Maintaining fees under $0.01.

Network Stability: Simulating high-volume usage with millions of daily transactions.

We will also explore other exchanges, such as Binance, Coinbase, Kraken, and Uniswap, to ensure a comprehensive evaluation of viable trading platforms. Radium is a decentralized exchange (DEX) on Solana. They have been initially selected for this phase of analysis due to its:

Integration with Solana: Optimized for Solana-native assets, offering fast and low-cost trading.

Liquidity Pools: Facilitates efficient trading with minimal slippage, supporting experimental tokens.

User Accessibility: Provides an intuitive interface for participants to interact with the experimental ecosystem.

Building a new economy requires recognizing and rewarding those who selflessly perform essential roles that uphold society—first responders, educators, and combat veterans. Their service forms the backbone of a thriving community, and the M3 design seeks to ensure they share in the value they help create.

1,000,000 tokens from the Creator and Community Incentive Pool are reserved exclusively for these vital contributors. A dedicated wallet will be assigned to a qualified organization capable of managing any distributions according to the final research design.

Through this initiative, M3 not only fosters economic opportunity but also upholds a core principle: those who sacrifice for society should share in its prosperity.

In this research, we will also explore charitable organizations supporting those in need, examining how the incentive pool and treasury can be leveraged to fund their efforts in alignment with the project's objectives. Our aim is to identify opportunities where BitcoinM3’s self-sustaining design can drive meaningful, long-term impact while maintaining consistency with its economic and social mission. This process will be conducted with strict adherence to:

SEC regulations for compliance

Charity guidelines for transparency and fairness

U.S. tax strategies for maximum efficiency

True capitalism optimizes outcomes across all sectors of society, driving superior standards of living compared to alternative economic models.

The Bitcoin Mark 3 (M3) experiment is a conceptual research initiative designed to explore blockchain scalability, value creation, and governance frameworks. It is not a financial product, investment vehicle, or security, and does not constitute an offer, solicitation, or commercial endeavor at this stage.

Proceeds from token participation are used to fund the research and development of the Bitcoin Mark 3 (M3) experiment.

Tokens are issued as commemorative artifacts of participation, granting access to experimental testing features such as scalability validation, governance simulations, and transaction mechanisms.

Tokens do not represent ownership, equity, profit-sharing rights, or any expectation of financial return.

This initiative is conducted exclusively as an academic and exploratory experiment, with no guarantees of financial performance or adoption.

Participants engage in this experiment voluntarily and assume all risks, including the possibility of total loss of any contributions.

If a participant chooses to trade, transfer, or use tokens, they do so at their own risk and sole responsibility.

M3 makes no representations or guarantees regarding the legal requirements, liquidity, valuation, or market acceptance of any token. The participant is fully responsible for their actions and participation.

The manner in which users choose to utilize M3 tokens is solely their responsibility, and M3 holds no liability for any actions taken by participants using these tokens.

This experiment includes forward-looking statements regarding potential blockchain applications, economic impact, and governance models. These statements are subject to risks, uncertainties, and evolving regulatory landscapes that could cause actual developments to differ from initial projections.

M3 does not guarantee the feasibility, viability, or future commercial application of any experimental findings.

Any potential transition toward commercialization would require further regulatory review and full compliance with applicable laws.

Should the research support commercialization, management of the project will transition to a designated DAO selected for that purpose.

This project is not affiliated with any external organizations, projects, or foundations at this stage.

By participating, individuals acknowledge and accept these terms, engaging solely for research purposes and with the understanding that this is an experimental, non-commercial initiative at this stage.

This research initiative is conducted with a commitment to open sharing of findings. Results will be made publicly available to foster innovation and improvement in blockchain technologies.

A decentralized system can support practical applications such as transfers and programmable contracts in ways that differ from Bitcoin. Additionally, developing a framework that enables greater liquidity and stability could enhance its potential as a medium of exchange.

Bitcoin’s Usability Challenges

High fees and slow speeds limit micro-transaction use.

Lack of native programmability without additional layers (e.g., Lightning Network).

M3 Experimental Focus

Enable fast, low-cost micro-transactions for digital goods.

Integrate programmable features for conditional transactions, compliance, and escrow functions.

Develop optional tethering, along with rights and privilege management, to assess different capabilities.

Simulate governance through participant voting mechanisms. Develop the base capability to create an irrevocable method to vote.

High participant satisfaction with usability across simulated scenarios, positioning M3 design as a practical, stable, decentralised transactional solution.

The experiment will be deemed successful if it achieves the following.

Demonstrates that modern blockchain infrastructure can achieve faster, energy efficient, lower-cost, and more scalable transaction processing, surpassing Bitcoin’s performance benchmarks.

Validates the practicality of decentralized systems for real-world applications, including micro-transactions, programmable contracts, and governance simulations.

Model the GDP and impact to the nation of creating a new asset that resolves the wealth gap.

Tests the feasibility of tethered treasury to a value creation, growth mechanism to reduce volatility and generate intrinsic value, addressing a key limitation in Bitcoin’s static economic design.

Highlights the importance of modular architecture for adapting to new technologies, ensuring long-term viability and security.

Provides a direct comparison of performance metrics, security. demonstrating measurable improvements over Bitcoin’s existing framework.

Provides a direct comparison of general wealth creation, accessibility, impact to GDP, the deficit and national debt driving discernible results over the Bitcoin experience to date.

Metric

Bitcoin

M3 Target

Transaction Speed

~7 TPS

~65,000 TPS

Transaction Cost

~$1.50–$2.50

<$0.01

Settlement Time

~10 minutes

<1 second

Treasury Growth Mechanism

None

Tethered to financial assets

Energy Consumption

~127 TWh annually

~3,186 MWh annually

Participants play a vital role in validating the experiment’s hypotheses and shaping its outcomes. Through their involvement, they contribute to:

Testing scalability and transactional capabilities.

Evaluating usability in simulated real-world applications.

Assessing governance models and treasury mechanisms.

Demonstrating portability across blockchain platforms.

A modular design ensures the system's portability across blockchain platforms, future-proofing M3 against obsolescence. The Treasury drives value creation, while the service delivers utility. As long as new technologies support the required features, M3 can migrate seamlessly, linking the service to the Treasury without dependency on any single platform.

Bitcoin’s Static Architecture

Lacks portability, making it difficult to transition to new technologies or adapt to changing demands. Security issues could render the technology unusable or obsolete.

M3 Testing Approach

Validate the system’s ability to migrate seamlessly to alternative blockchain platforms.

Maintain functionality and user engagement across migrations.

Establish SEC compliant Treasury tethering procedures to securely mate to new technologies.

Demonstration of adaptability and longevity, ensuring resilience against technological advancements.

Validate whether decentralized systems like M3 can maintain transactional efficiency while dramatically reducing environmental impact.

Bitcoin’s Energy Usage

Bitcoin’s Proof of Work (PoW) consensus consumes an estimated 127 terawatt-hours (TWh) annually, comparable to the energy usage of some entire countries.

M3 on Solana

Solana’s Proof of History (PoH) mechanism requires significantly less energy, with an estimated annual energy consumption of 3,186 megawatt-hours (MWh), which is orders of magnitude lower than Bitcoin’s usage.

Modern capabilities drive efficiency. Legacy technologies are typically replaced by the faster and more efficient evolutions. There are technologies that can deliver the services required at a fraction of the energy usage.

Designing a regulatory compliant method for a tethered treasury mechanism that can create intrinsic value, overcoming Bitcoin’s reliance on scarcity and speculative interest.

Bitcoin’s Value Dynamics

Scarcity-based valuation (fixed supply of 21 million coins).

No intrinsic mechanisms for economic growth or value creation.

M3 Treasury Framework

Retain the scarcity advantage of Bitcoin (fixed supply of 21 million coins).

Simulate tethering 30% of reserves to financial instruments like the S&P 500 and Nasdaq 100.

Reinvest transaction fees to generate compounding growth.

Provide stability through financial diversification.

M3’s integration with real-world financial instruments not only reduces price volatility but also fosters sustained economic impact by reinvesting in index funds such as the S&P 500, Nasdaq 100, and Dow Jones. This strategy anchors M3’s value to historically stable financial benchmarks, ensuring long-term asset growth while supporting broader economic expansion.

Historically, the S&P 500 has delivered ~10x growth over 30 years, averaging 8-10% annual returns. By reinvesting reserves into these index funds, M3 channels liquidity into the real economy, fueling business growth, job creation, and corporate innovation. This approach enhances financial stability while aligning M3 with established wealth-generating mechanisms, bridging the gap between digital assets and traditional markets.